Nasdaq 100 Eyeing Fresh ATH Supported by Nvidia’s Earnings Beat

The tech-heavy Nasdaq 100 index finds itself on the cusp of a significant milestone, once again eyeing a fresh all-time high. This renewed bullish momentum is largely being propelled by the spectacular performance of semiconductor giant Nvidia, whose recent earnings report delivered a powerful jolt of optimism across the technology sector and broader markets. For young investors keenly observing the ebbs and flows of the modern economy, this narrative underscores the profound influence a single dominant company, particularly one at the forefront of a transformative technological shift like artificial intelligence, can wield over an entire index. The current market dynamic offers a vivid illustration of how innovation and robust financial results can cascade through the investing landscape, dictating sentiment and valuations.

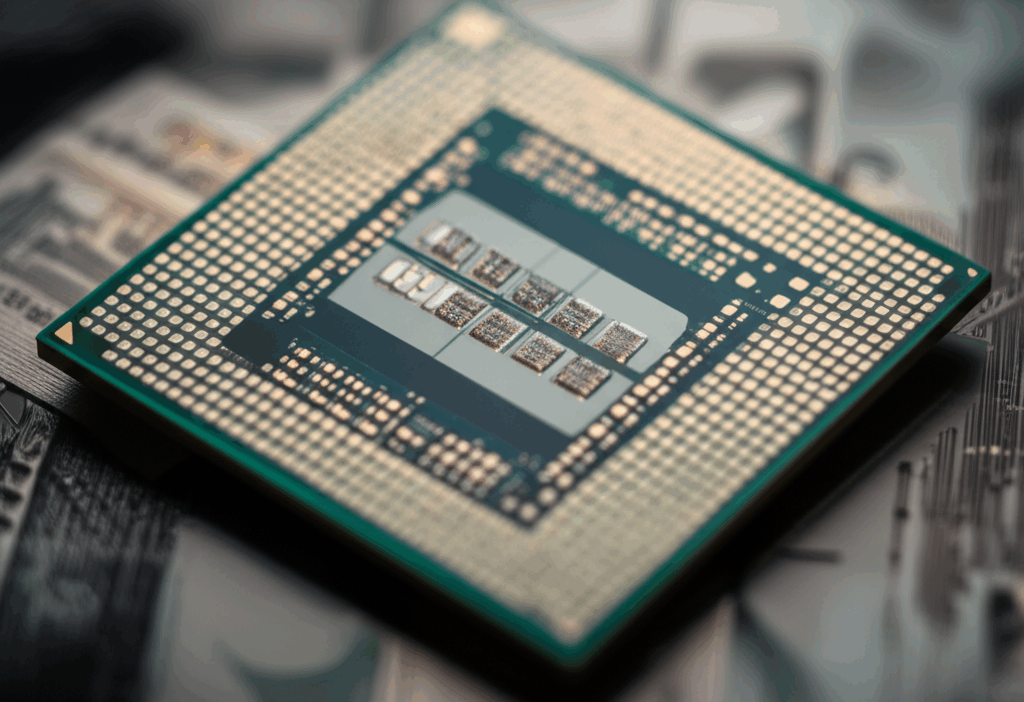

Nvidia, a foundational pillar in the burgeoning artificial intelligence revolution, has consistently defied expectations, and its latest quarterly earnings report was no exception. The company not only surpassed Wall Street’s revenue and earnings per share forecasts but also provided an outlook that painted a picture of insatiable demand for its cutting-edge AI chips. This “earnings beat” was more than just a win for a single company; it served as a resounding validation of the massive investment and burgeoning opportunities within the AI ecosystem. As the primary provider of the graphics processing units (GPUs) essential for training and deploying complex AI models, Nvidia’s financial health is a critical barometer for the industry’s trajectory. Its robust performance signifies that the AI boom is not merely hype but a tangible economic force, driving significant capital expenditure from cloud service providers, enterprises, and even nation-states striving for technological supremacy. Given Nvidia’s substantial market capitalization and its prominent weighting within the Nasdaq 100, its strong showing naturally translates into upward pressure on the entire index. Investors interpret Nvidia’s success as a bellwether, signaling healthy demand and growth prospects for other companies deeply involved in or benefiting from the AI explosion, including cloud computing giants, software developers, and other hardware innovators.

The Nasdaq 100, comprising the 100 largest non-financial companies listed on the Nasdaq Stock Market, is heavily concentrated in technology and growth stocks, a composition that makes it particularly sensitive to the performance of its largest constituents. The so-called “Magnificent Seven” – a group that includes Apple, Microsoft, Alphabet, Amazon, Meta Platforms, Tesla, and notably, Nvidia – collectively wield enormous influence over the index’s direction. These tech titans have been instrumental in driving the market’s recovery and ascent, largely on the back of their perceived resilience, strong balance sheets, and their strategic positioning within high-growth areas like cloud computing and AI. Nvidia’s stellar results reinforce the narrative that these mega-cap tech firms are not just weathering economic uncertainties but are thriving, leveraging their scale and innovation to capture new opportunities. This concentration of power means that when a key player like Nvidia delivers exceptional results, the ripple effect is profound, lifting the fortunes of numerous other companies within the index and fostering a broad sense of optimism. Furthermore, the market’s current trajectory is also supported by a broader economic context, including expectations of stable interest rates or even potential cuts by central banks, coupled with a resilient job market, which collectively tend to favor growth-oriented equities.

As the Nasdaq 100 inches closer to uncharted territory, fueled by the relentless innovation of companies like Nvidia, it presents a compelling picture for those navigating the financial markets. While the momentum is undeniable, savvy young investors understand the importance of a balanced perspective. The concentration of market gains in a relatively small number of companies, while indicative of strong fundamental performance, also introduces elements of risk. Over-reliance on a few dominant players can lead to heightened volatility if any of these firms face unforeseen challenges or if the broader economic narrative shifts. Nevertheless, for now, the prevailing sentiment is one of bullish confidence, with Nvidia’s strong earnings acting as a powerful tailwind. The journey of the Nasdaq 100 towards a potential new all-time high is a testament to the enduring power of technological advancement and its capacity to reshape investment landscapes, offering both exciting opportunities and the imperative for continuous, informed analysis.