Semiconductor Index Rally Intact, but Elliott Wave Eyes Final Leg Before Drop

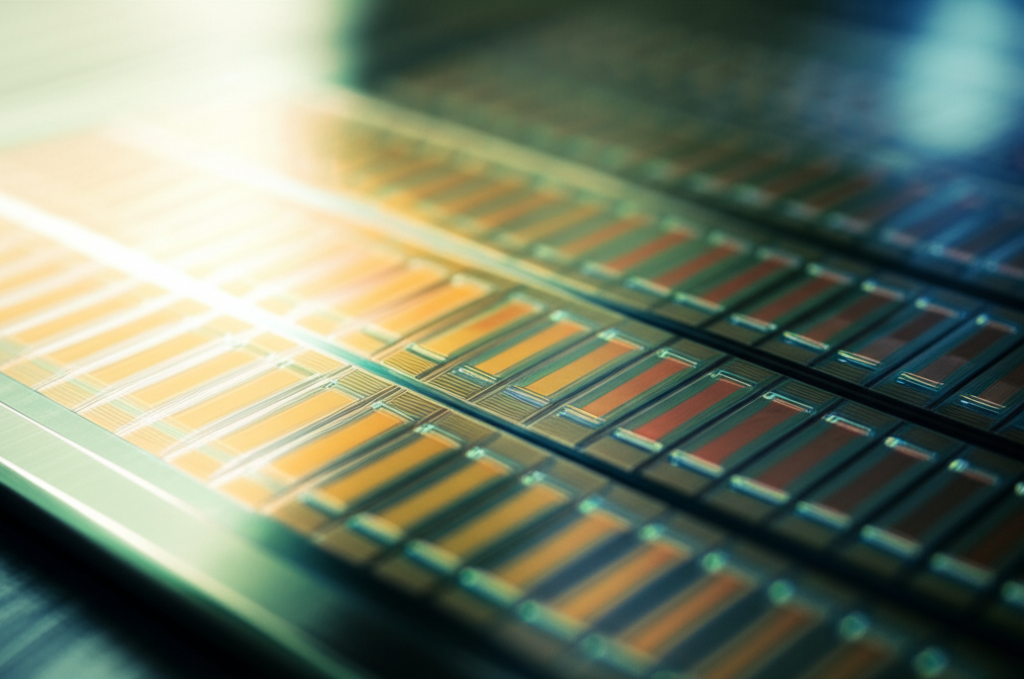

The semiconductor industry, often dubbed the “new oil” for its foundational role in the digital economy, has been on an exhilarating ride. From powering artificial intelligence (AI) breakthroughs and data centers to enabling the latest consumer electronics and advanced automotive systems, demand for chips has surged, propelling the sector’s stock performance to impressive heights. Indices tracking these bellwether companies have seen robust gains, cementing the perception of a strong and seemingly unstoppable rally. Yet, amidst this bullish sentiment, a specific school of technical analysis Elliott Wave Theory is flashing a nuanced signal, suggesting that while the upward momentum is still present, the current rally may be entering its ultimate phase before a significant pullback.

For young investors navigating the dynamic world of finance, understanding the forces at play in a sector as critical as semiconductors is paramount. The current strength of the semiconductor market is undeniable. Driven by insatiable demand for generative AI, which requires immense computational power and specialized chips, leading manufacturers have seen their order books swell. Beyond AI, the ongoing digitization of industries, the expansion of cloud computing, and the proliferation of IoT devices continue to underpin a robust demand environment. Supply chain bottlenecks, a major headache just a couple of years ago, have largely eased, allowing companies to ramp up production and capitalize on this demand. Major players in the space have consistently beaten earnings expectations, and innovation cycles are accelerating, promising even more advanced and efficient chips in the pipeline. This fundamental strength has translated directly into stock market performance, with key semiconductor indices demonstrating sustained upward trajectories, often outperforming the broader market.

However, financial markets are rarely a one-way street, and technical analysts often look for patterns that might hint at future movements, regardless of current enthusiasm. Enter Elliott Wave Theory, a fascinating and sometimes contentious method of technical analysis developed by Ralph Nelson Elliott in the 1930s. At its core, Elliott Wave Theory posits that financial markets move in predictable, repetitive cycles or “waves,” driven by investor psychology. These patterns are fractal, meaning they can be observed on both long-term and short-term charts. The most fundamental pattern is the “five-wave impulse” in the direction of the main trend, followed by a “three-wave corrective” pattern against the trend. The impulse phase consists of five waves (numbered 1, 2, 3, 4, 5), where waves 1, 3, and 5 are impulsive (in the direction of the trend), and waves 2 and 4 are corrective (against the trend). After the completion of this five-wave sequence, a larger corrective phase (often labeled A, B, C) typically begins, signaling a significant pullback or reversal.

When the headline points to the “Semiconductor Index Rally Intact, but Elliott Wave Eyes Final Leg Before Drop,” it suggests that analysts applying this theory believe the current uptrend in semiconductor stocks is currently in its fifth and final wave of a larger impulse pattern. This “final leg” implies that while there might still be some upside potential remaining, the market is nearing a point of exhaustion for the current bullish cycle. Following the completion of this fifth wave, Elliott Wave practitioners anticipate a substantial corrective phase. This doesn’t necessarily mean a market crash, but rather a significant retracement or consolidation that could see prices pull back considerably from their highs. Such a “drop” would be considered a natural part of the market cycle, resetting conditions before a potential new upward impulse can begin.

For investors, particularly young adults looking to build wealth, this analysis presents a crucial point of consideration. While the fundamental drivers for semiconductors remain strong, a technical warning signal like this encourages prudence. It’s a reminder that even the most robust rallies eventually pause or correct. This perspective does not invalidate the underlying value or long-term growth potential of the semiconductor industry but rather advises caution regarding the immediate future price trajectory. Other factors, such as the macroeconomic environment (inflation, interest rates), geopolitical tensions, and the pace of technological adoption, will also play significant roles. Relying solely on one analytical tool is rarely advisable; a holistic approach that combines fundamental analysis with technical insights and a keen awareness of broader market conditions is essential for making informed investment decisions. Staying diversified and understanding your risk tolerance becomes even more critical in such scenarios, ensuring you’re prepared for potential market volatility.