**Fed Chair Powell Assures Focus on Mitigating Long-Term Inflationary Effects of Tariffs**

Federal Reserve Chair Jerome Powell recently addressed concerns about the potential for tariffs to contribute to sustained inflation, emphasizing the central bank’s commitment to containing any long-term price pressures. Speaking at a press conference following the latest Federal Open Market Committee (FOMC) meeting, Powell acknowledged that tariffs could push prices higher in the short term. However, he stressed that the Fed is closely monitoring the situation and is prepared to take appropriate action to prevent these temporary price increases from becoming entrenched.

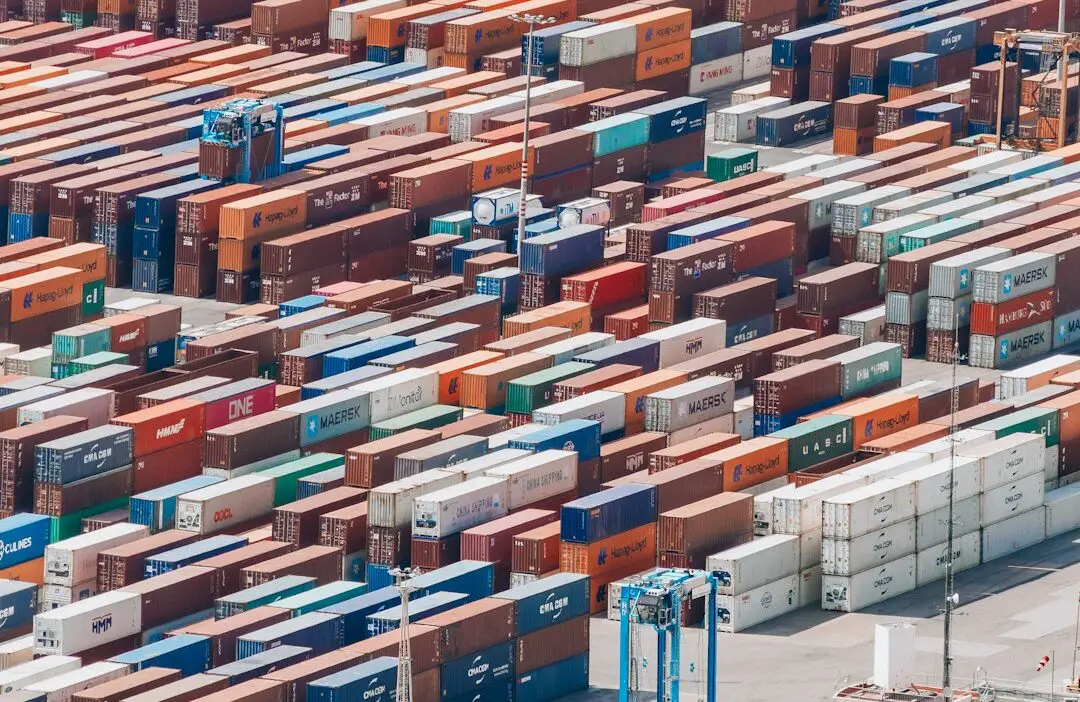

Powell’s comments come amidst ongoing trade tensions and the implementation of various tariffs. While these measures are intended to protect domestic industries and address trade imbalances, they can also lead to higher costs for businesses and consumers. This can manifest as increased prices for imported goods, which can then ripple through the broader economy. The Fed’s mandate is to maintain price stability and promote maximum employment, and navigating these complex trade-related challenges is crucial to fulfilling that mandate.

The Fed chair reiterated that the central bank’s primary focus remains on sustaining the current economic expansion while keeping inflation in check. He highlighted the importance of data-driven decision-making and stressed that the Fed will continue to assess the evolving economic landscape, including the impact of tariffs, in determining the appropriate course of monetary policy. This suggests that while the Fed recognizes the potential inflationary risks associated with tariffs, it is not currently anticipating a significant or persistent surge in inflation. Powell’s reassuring tone aims to bolster public confidence that the central bank is actively working to mitigate any adverse long-term consequences stemming from current trade policies. He emphasized the Fed’s commitment to its dual mandate and its readiness to adapt its policies as needed to navigate the complexities of the current global economic environment.