Jabil Stock Hits Highs on AI Tailwinds and Strong Buybacks

In a striking testament to strategic execution and timely market positioning, shares of Jabil Inc. (JBL) have recently scaled new heights, captivating investors and analysts alike. This surge is not merely a fleeting moment but appears to be fundamentally underpinned by two powerful catalysts: the burgeoning demand fueled by artificial intelligence (AI) advancements and a robust, ongoing share repurchase program. For young adults navigating the complexities of the modern financial landscape, Jabil’s trajectory offers a compelling case study in how a legacy manufacturing giant can adapt and thrive amidst technological revolutions.

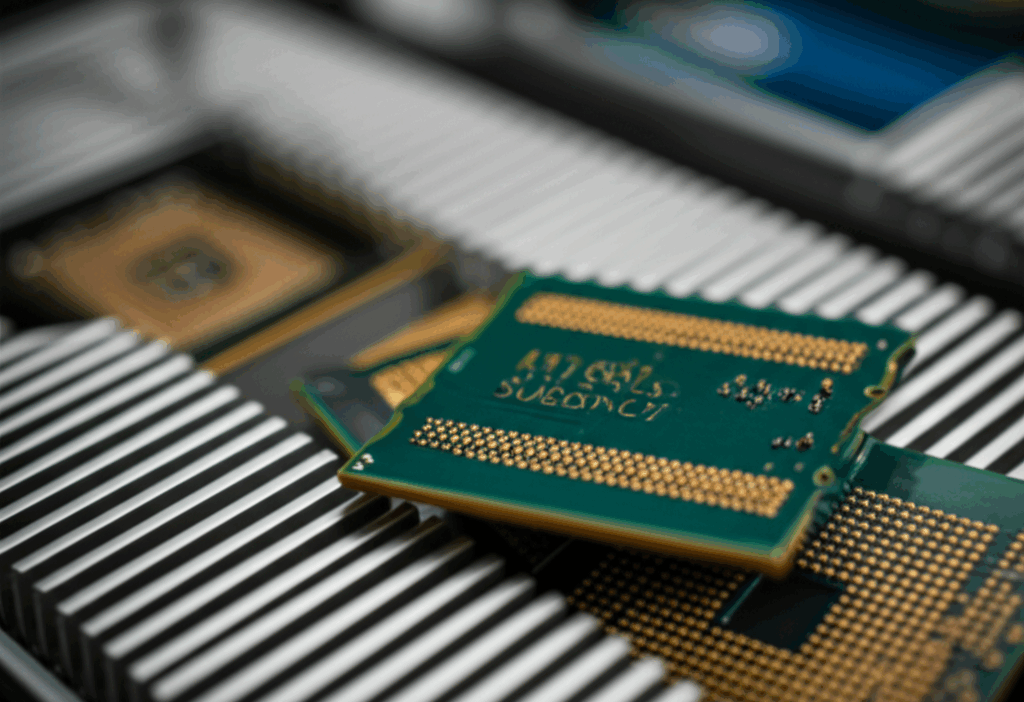

Jabil, a global manufacturing services company with a sprawling footprint across continents, is far more than a traditional factory. It is a critical enabler of innovation, providing comprehensive design, manufacturing, supply chain, and product management services for some of the world’s leading brands. While many might not recognize the name Jabil directly, their products underpin crucial sectors from healthcare and automotive to consumer electronics and, most pertinently, advanced computing infrastructure. It is within this latter domain that Jabil’s direct exposure to the AI boom becomes evident. As AI technologies like generative AI continue their rapid proliferation, the demand for sophisticated hardware – particularly high-performance servers, advanced data centers, and intricate cooling solutions – has skyrocketed. Jabil, through its significant capabilities in cloud and enterprise infrastructure, is uniquely positioned to capitalize on this megatrend. The company’s expertise in assembling complex AI server racks, developing advanced cooling systems essential for powerful processors, and managing the intricate supply chains for these components makes it an indispensable partner for tech giants building out their AI capabilities. This isn’t just about assembling parts; it’s about providing the engineering prowess and manufacturing scale necessary to bring cutting-edge AI hardware from concept to market at an unprecedented pace. The “AI tailwinds” are not merely a narrative but are translating into tangible revenue growth and expanding order books, particularly within Jabil’s Data Center & AI Platforms segment.

Beyond the organic growth driven by technological shifts, Jabil’s financial strategy has played an equally crucial role in bolstering its stock performance: an aggressive and consistent share buyback program. Share repurchases are a common corporate action where a company buys back its own stock from the open market. This reduces the number of outstanding shares, which in turn increases earnings per share (EPS) and often signals management’s confidence in the company’s future prospects, making the remaining shares more valuable. Jabil has been actively engaged in this strategy for several periods, demonstrating a commitment to returning capital to shareholders and optimizing its capital structure. The company has allocated significant capital towards these buybacks, a move that provides a consistent floor for the stock price and amplifies the positive impact of operational successes. This financial discipline, coupled with impressive free cash flow generation, allows Jabil to execute these buybacks without compromising its investment in future growth or operational efficiency. For an investor, a company that combines strong operational tailwinds with shrewd capital management presents an exceptionally attractive proposition. It indicates a management team that is not only effectively navigating market opportunities but also committed to enhancing shareholder value directly.

In conclusion, Jabil’s journey to new stock highs is a compelling narrative of a company successfully harnessing both macro-economic trends and disciplined financial strategy. The insatiable demand for AI infrastructure positions Jabil at the forefront of a technological revolution, transforming what might traditionally be seen as a manufacturing business into a pivotal player in the digital age. Simultaneously, its commitment to share buybacks provides a structural uplift to its stock, reinforcing investor confidence and demonstrating a clear focus on shareholder returns. As the global economy continues to evolve, companies like Jabil, which can adapt their core competencies to new technological paradigms while maintaining robust financial health, are likely to remain beacons of stability and growth for astute investors. Their current success story serves as a prime example of how traditional industrial strength can merge seamlessly with future-forward innovation, creating substantial value in the process.