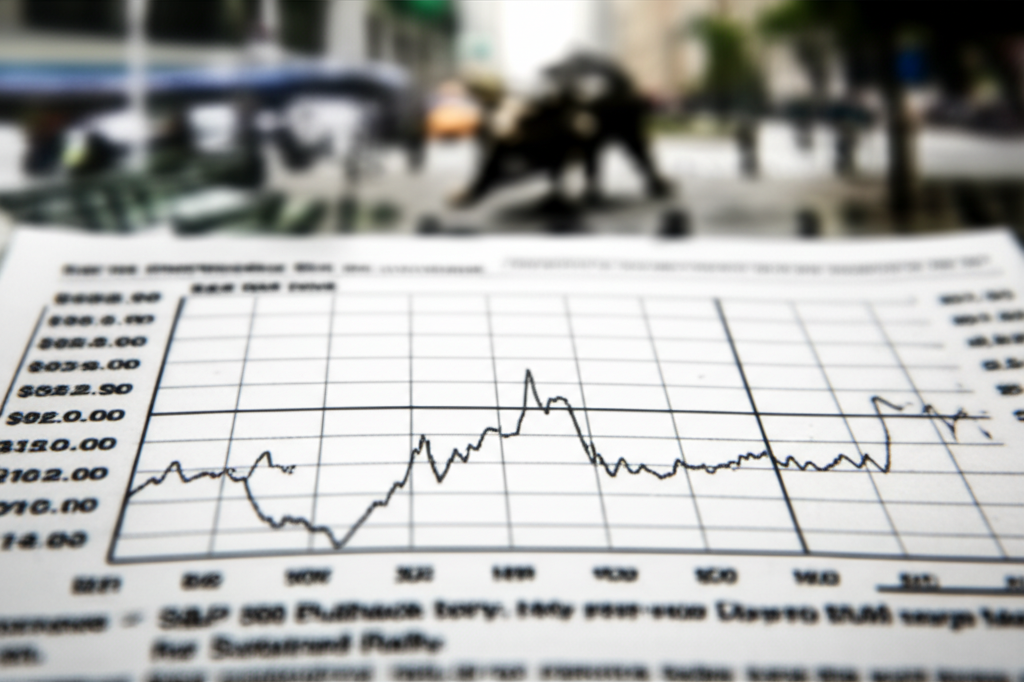

S&P 500: Seasonality Warns of Pullback Before Multi-Week Rally

For young investors navigating the dynamic world of stocks, understanding market rhythms is akin to learning the tides of an ocean. While predicting exact movements remains an elusive goal, historical patterns can offer valuable insights, helping to temper expectations and identify potential opportunities. One such pattern frequently discussed by market analysts is seasonality – the tendency for financial markets to exhibit predictable ups and downs at certain times of the year. Recent analyses suggest that the S&P 500, the benchmark for large-cap U.S. equities, may be heading into a period of seasonal weakness, possibly a short-term pullback, before setting the stage for a more robust, multi-week rally.

The concept of market seasonality isn’t about precise forecasting but rather observing recurring trends influenced by factors ranging from corporate earnings cycles to holiday trading volumes and even investor psychology. Think of it less as a crystal ball and more as a historical weather report, indicating that certain periods tend to be drier or wetter. For instance, the adage “sell in May and go away” points to a historical tendency for the period from May through October to underperform compared to the November to April stretch. While not a strict rule, and certainly not applicable every year, such observations highlight how market behavior can be influenced by calendar-related effects. Currently, the spotlight is on an anticipated near-term dip, a potential “cooling off” period for the S&P 500, which has demonstrated remarkable resilience and growth over recent periods. This suggested pullback is often attributed to factors like profit-taking after strong runs, reduced trading volumes during summer months, or institutional rebalancing ahead of new fiscal periods. For investors in their 20s and early 30s, this potential dip isn’t a signal for panic but rather an invitation to understand market mechanics and potentially re-evaluate their long-term strategies.

Delving deeper into why such a pattern might emerge, several elements typically contribute to these seasonal shifts. Periods like late summer or early autumn have historically seen softer market performance, partly due to a natural reduction in trading activity as institutions and individuals take vacations. This lower liquidity can sometimes amplify price movements on less significant news. Furthermore, the market often pauses to digest a confluence of factors, including upcoming corporate earnings reports, the Federal Reserve’s stance on interest rates, and evolving geopolitical landscapes. Investors might be taking profits off the table after a strong run, anticipating potential headwinds or simply reallocating portfolios. However, this anticipated pullback isn’t predicted to be a prolonged downturn but rather a “healthy correction” – a natural cleansing process that can reset valuations and shake out speculative froth. This kind of volatility is a normal part of market cycles, offering a chance for underlying fundamentals to catch up with often optimistic price movements. The key takeaway for the savvy investor is that market pullbacks, while unsettling in the moment, are not uncommon and are frequently followed by periods of growth.

The more optimistic part of the forecast points to a “multi-week rally” that is expected to follow this seasonal weakness. This anticipated rally is often anchored by a combination of improving economic data, strong corporate earnings, and a shift in investor sentiment as the year progresses. Historically, the latter part of the year, particularly the fourth quarter and early new year, has often been a period of robust performance for the S&P 500, sometimes dubbed the “Santa Claus rally” or “year-end rally.” This phenomenon can be driven by factors such as holiday spending boosts, institutional window dressing (where fund managers buy stocks that have performed well to improve their year-end statements), and renewed optimism for the coming year. As inflation concerns potentially ease and central banks signal a more accommodative stance, the macroeconomic backdrop could become more favorable, fueling renewed investor confidence. For young investors, this perspective underscores the importance of a long-term view. While a short-term dip might seem daunting, especially with limited experience, it often represents a buying opportunity for those committed to dollar-cost averaging and accumulating assets over time. Understanding that market cycles involve both ebbs and flows can help young adults avoid emotional decisions and instead adopt a disciplined, strategic approach to their investment portfolios, focusing on quality companies and diversified exposure. Ultimately, seasonality serves as a reminder that market movements are rarely linear, and preparedness, coupled with a long-term outlook, is often the investor’s greatest asset.