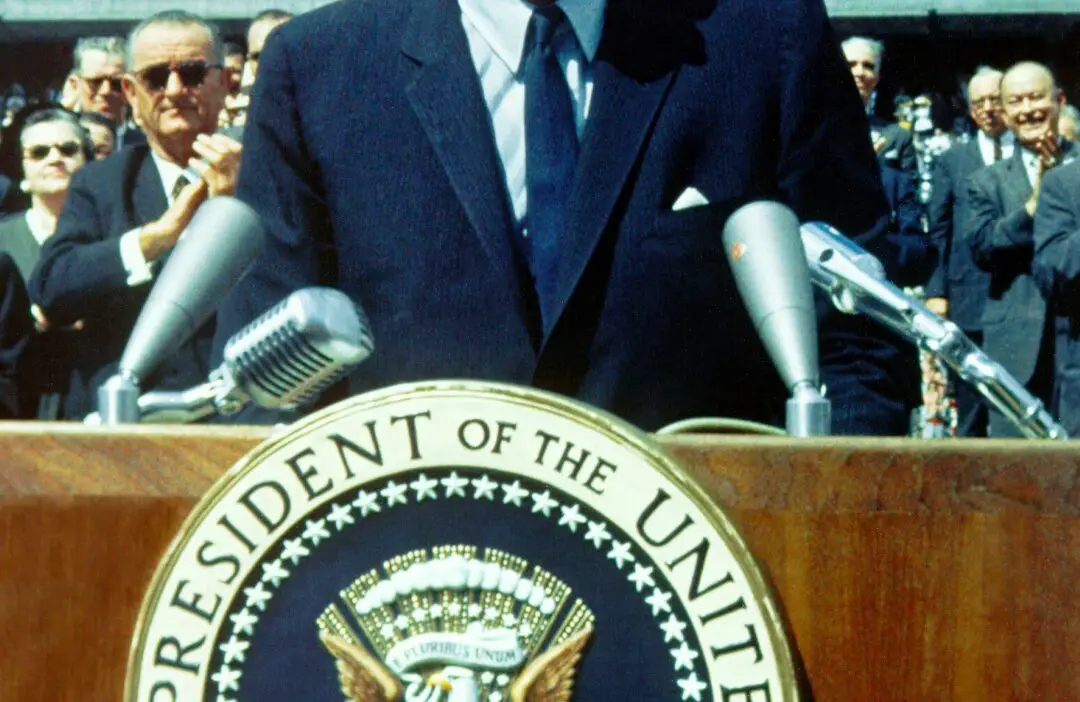

## Trump Revives JFK Assassination Conspiracy, Sparking Debate and Distraction

Former President Donald Trump has once again ignited controversy, this time by publicly questioning whether Lee Harvey Oswald acted alone in the assassination of President John F. Kennedy. During a recent interview, Trump alluded to the existence of a “second shooter” and implied a larger conspiracy, echoing long-debunked theories surrounding the tragic event. This latest foray into historical speculation comes as the former president faces numerous legal challenges and seeks to maintain his relevance in the political arena.

For young people focused on economics and finance, this might seem like a distant historical footnote. However, the ripple effects of such pronouncements can have tangible economic consequences. Consider the impact on market stability. Uncertainty, particularly surrounding political figures, can breed volatility. While unlikely to cause a major market swing, these kinds of distractions can shift investor focus away from economic fundamentals and towards political theater. This can create short-term fluctuations and potentially impact investment decisions, particularly for those newer to the market.

Furthermore, Trump’s rhetoric highlights the broader issue of misinformation and its potential to erode trust in institutions. In a world increasingly reliant on accurate data for financial decision-making, the proliferation of conspiracy theories can undermine faith in established sources of information. This can create an environment where sound economic principles are overshadowed by emotionally charged narratives, potentially leading to poor investment choices and financial instability. Understanding the interplay between political discourse and economic realities is crucial for young investors navigating today’s complex landscape. While the JFK assassination remains a historical puzzle, focusing on verifiable economic data and avoiding speculative distractions is paramount for building a secure financial future.